| Equity | Code/Explanation |

|---|---|

| Anadolu Efes Biracılık ve Malt Sanayii A.Ş. | AEFES |

| Akbank T.A.Ş. | AKBNK |

| Aksa Energy A.Ş. | AKSEN |

| Alarko Holding A.Ş. |

ALARK |

| Arçelik A.Ş. | ARCLK |

| Aselsan A.Ş. | ASELS |

| Astor Enerji A.Ş. | ASTOR |

| BİM Birleşik Mağazalar A.Ş. | BIMAS |

| Borusan Birleşik Boru Fabrikaları Sanayi ve Ticaret A.Ş. | BRSAN |

| Çimsa Çimento Sanayi ve Ticaret A.Ş. | CIMSA |

| Doğuş Otomotiv Servis ve Ticaret A.Ş. | DOAS |

| Doğan Holding A.Ş. | DOHOL |

| Emlak Konut Gayrimenkul Yatırım Ortaklığı A.Ş. | EKGYO |

| Enerjisa Enerji A.Ş. | ENJSA |

| ENKA İnşaat ve Sanayi A.Ş | ENKAI |

| Ereğli Demir ve Çelik Fabrikaları T.A.Ş. | EREGL |

| Ford Otomotiv Sanayi A.Ş. | FROTO |

| Gübre Fabrikaları T.A.Ş. | GUBRF |

| Hektaş Ticaret T.A.Ş. | HEKTS |

| H.Ö. Sabancı Holding A.Ş. | SAHOL |

| Kardemir Karabük Demir Çelik Sanayi ve Ticaret A.Ş. | KRDMD |

| Koç Holding A.Ş. | KCHOL |

| Kontrolmatik Teknoloji Enerji ve Mühendislik A.Ş. | KONTR |

| Koza Anadolu Metal Madencilik A.Ş. | KOZAA |

| Koza Altın İşletmeleri A.Ş. | KOZAL |

| Migros Ticaret A.Ş. | MGROS |

| Odaş Elektrik Üretim Sanayi Ticaret A.Ş. | ODAS |

| Oyak Çimento Fabrikaları A.Ş. | OYAKC |

| Pegasus Hava Taşımacılığı A.Ş. | PGSUS |

| Petkim Petrokimya Holding A.Ş. | PETKM |

| Sasa Polyester Sanayi A.Ş. | SASA |

| Şok Marketler Ticaret A.Ş. | SOKM |

| T. Garanti Bankası A.Ş | GARAN |

| T. İş Bankası A.Ş | ISCTR |

| Tofaş Türk Otomobil Fabrikası A.Ş. | TOASO |

| Tüpraş Türkiye Petrol Rafinerileri A.Ş. | TUPRS |

| Türk Hava Yolları A.O. | THYAO |

| Türk Telekomünikasyon A.Ş. | TTKOM |

| Turkcell İletişim Hizmetleri A.Ş. | TCELL |

| Türkiye Halk Bankası A.Ş. | HALKB |

| Türkiye Sınai Kalkınma Bankası A.Ş. | TSKB |

| Türkiye Şişe ve Cam Fabrikaları A.Ş. | SISE |

| TAV Havalimanları A.Ş. | TAVHL |

| Tekfen Holding A.Ş. | TKFEN |

| Türkiye Vakıflar Bankası T.A.O. | VAKBN |

| Vestel Elektronik Sanayi ve Ticaret A.Ş. | VESTL |

| Ülker Bisküvi Sanayi A.Ş. | ULKER |

| Yapı ve Kredi Bankası A.Ş. | YKBNK |

| Index | Code/Explanation |

|---|---|

| BIST 30 Price Index | XU030D |

| BIST Liquid Banks Price Index | XLBNKD |

| BIST Liquid 10 Ex Banks Price Index | X10XBD |

| BIST Sustainability 25 Price Index | XSD25D |

| Currency | Code/Explanation |

|---|---|

| USD/TRY Parity | USDTRY |

| EUR/TRY Parity | EURTRY |

| EUR/USD Parity | EURUSD |

| RUB/TRY Parity | RUBTRY |

| CNH/TRY Parity | CNHTRY |

| GBP/USD Parity | GBPUSD |

| Precious Metals | Code/Explanation |

|---|---|

| Pure Gold (TL/Gram) | XAUTRY |

| Pure Gold (Dolar/Ounce) | XAUUSD |

| Pure Silver (Dolar/Ounce) | XAGUSD |

| Palladium (Dolar/Ounce) | XPDUSD |

| Platinum (Dolar/Ounce) | XPTUSD |

| Metal | Code/Explanation |

|---|---|

| Copper (Dolar/Tonne) | XCUUSD |

| Electricity | Code/Explanation |

|---|---|

| Base Load Electricity | ELCBAS |

| Foreign Indices | Code/Explanation |

|---|---|

| The Sarejevo Stock Index 10 | SASX 10 |

| Interest | Code/Explanation |

|---|---|

| Turkish Lira Overnight Reference Rate | TLREF |

| Government Bonds | Code/Explanation |

|---|---|

| Government Bonds |

TRT020926T17 |

For further information please refer to the Derivatives Market Procedure

The specifications and codes of the contracts to trade on the Market will be announced by the Exchange. For Futures Contracts, the contract code includes information on instrument group, underlying asset, contract size and expiration date.

Table 1: Code For Futures Contracts

| Code | Explanation |

|---|---|

| F_ | Instrument group (Futures) |

| XAUTRY | Underlying asset code |

| M | Contract code regarding the contract size |

| 0317 | Expiration date (Ex. March 2017) |

For Option Contracts, the contract code includes information on instrument group, underlying asset, contract size, exercise style, expiration date, option class and strike price.

Table 2: Code For Options Contracts

| Code | Explanation |

|---|---|

| O_ | Instrument group (Options) |

| XU030 | Underlying asset code |

| E | Exercise style (A: American-The contractual right can be used on any date until or on expiry date, E: European-The contractual right can be used on expiry date) |

| 0417 | Expiration date (Ex. April 2017) |

| C | Option class (C: Call option P: Put option) |

| 1240,00 | Strike price |

Single Stock Futures and Options contracts subject to corporate action adjustments may have different contract specifications than standart contracts. Contract codes may have additional information such as N1, N2, N3 etc. indicating that the contract is non standart.

Intermonth strategy orders shall be sent to the System with strategy order codes determined as in the below instead of the contract codes.

Table 3: Intermonth Strategy Order Code

| Code | Explanation |

|---|---|

| F_ | Contract group to compose the intermonth strategy order (Futures) |

| XU030 | Underlying asset code |

| M2-M1 | Contract months included in the strategy (M1:nearest contract month – M2: second nearest contract month) |

Flexible contracts which are created by Exchange members by altering expiry day and/or strike price parameters of existing contracts with predefined constrains, are coded as follows:

Table 4: Contract Code for Flexible Option Contracts

| Code | Explanation |

|---|---|

| TM_O | Flexible Option Contract |

| XU030 | Underlying Asset Code |

| E | Exercise style (A: American-The contractual right can be used on any date until or on expiry date, E: European-The contractual right can be used on expiry date) |

| 250419 | Expiration Date (Ex. 25 April 2019) |

| C | Option class (C: Call option P: Put option) |

| 1235,00 | Strike Price |

Flexible contract codes, subjected to corporate action adjustment, may have additional information such as N1, N2, N3 etc. indicating that the contract is non standart.

Table 5: Contract Code for Flexible Future Contracts

| Code | Explanation |

|---|---|

| TM_F | Flexible Future Contract |

| USDTRY | Underlying asset code |

| P_ | Settlement code (P: Physical delivery) |

| 250419 | Expiration Date (Ex. 25 April 2019) |

For further information regarding Contract Codes on VİOP please refer to the Derivatives Market Procedure

Table 6: Contract Code for Pyhsically Delivered USD/TRY Future Contracts

| Code | Explanation |

|---|---|

| F_ | Instrument group (Futures) |

| P_ | Settlement code (P: Physical delivery) |

| USDTRY | Underlying asset code |

| 0322 | Expiration Date (Ex. March 2022) |

Table 7: Contract Code for Pyhsically Delivered USD/TRY Option Contracts

| Code | Explanation |

|---|---|

| O_ | Instrument group (Options) |

| P_ | Settlement code (P: Physical delivery) |

| USDTRY | Underlying asset code |

| E |

Exercise style (A: American-The contractual right can be used on any date until or on expiry date, E: European-The contractual right can be used on expiry date) |

| 0422 | Expiration date (Ex. April 2022) |

| C | Option class (C: Call option P: Put option) |

| 8950,00 | Strike Price |

Principles related price quotation and tick scales of the contracts are determined by the Exchange in the contract specifications.

| Security Type | Quotation and Minimum Price Tick | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

BIST 30 Index Futures |

1,00 TRY (Index Value) |

||||||||||||||||||

|

BIST Liquid Banks Futures |

1,00 TRY (Index Value) |

||||||||||||||||||

|

BIST Liquid 10 Ex Banks Futures |

1,00 TRY (Index Value) |

||||||||||||||||||

|

BIST Sustainability 25 Futures |

1,00 TRY (Index Value) |

||||||||||||||||||

|

BIST 30 Index Options |

0,01 TRY (Index Value) |

||||||||||||||||||

|

Single Stock Futures |

(According to price levels per underlying share)

|

||||||||||||||||||

|

Single Stock Options |

0,01 TRY (per underlying share) |

||||||||||||||||||

|

USDTRY Futures |

0,0010 TRY (per USD) |

||||||||||||||||||

|

EURTRY Futures |

0,0010 TRY (per EUR) |

||||||||||||||||||

|

EUR/USD Currency Futures |

0,0001 USD (per EUR) |

||||||||||||||||||

|

USDTRY Options |

0,1 TRY (per 1000 USD) |

||||||||||||||||||

|

Ruble/TRY Futures |

0,00001 TRY (per Ruble) |

||||||||||||||||||

|

Yuan/ TRY Futures |

0,0001 TRY (per Yuan) |

||||||||||||||||||

|

GBP/USD Currency Futures |

0,0001 USD (per GBP) |

||||||||||||||||||

|

Gold Futures |

0,10 TRY (per gram) |

||||||||||||||||||

|

USD/Ounce Gold Futures |

0,10 USD (per ounce) |

||||||||||||||||||

|

USD/Ounce Silver Futures |

0,010 USD (per ounce) |

||||||||||||||||||

|

USD/Ounce Palladium Futures |

0,10 USD (per ounce) |

||||||||||||||||||

|

USD/Ounce Platinum Futures |

0,10 USD (per ounce) |

||||||||||||||||||

|

USD/Tonne Copper Futures |

0,50 USD (per tonne) |

||||||||||||||||||

|

Base-Load Electricity Futures |

0,10 TRY (per 1MWh electricity) |

||||||||||||||||||

|

SASX 10 Index Futures |

0,25 TRY (Index Value) |

||||||||||||||||||

|

1 Month TLREF Futures |

0,01 (Reference Rate*100) |

||||||||||||||||||

|

Government Bond Futures |

0,001 (Government Bond with 100.000 TL nominal value/1000) |

||||||||||||||||||

For further information please refer to the Derivatives Market Procedure

The maturity months of the contracts are determined by the Exchange within the contract elements (For further information please refer to the Derivatives Market Procedure). In addition to standard contract months, flexible option contracts can be created for a maximum period of the expiry day up to 180 days, flexible future contracts can be created for a maximum period of the expiry day up to 364 days by users.

The contract maturity and last trading day of futures and standart options contracts is the last business day of each contract month. Expiry and last trading day are the expiration date for flexible options contracts and flexible future contract. In case domestic markets are closed for half day due to an official holiday, expiry date and last trading day shall be the preceding business day.

The settlement method for single stock futures, single stock options and government bond futures contracts are physical delivery. In this method for single stock futures and single stock options, dematerialized equities are exchanged at the expiry date. For government bond futures, physical delivery is realized by exchange of dematerialized government bonds.

The settlement methods for USD/TRY futures and USD/TRY option contracts are cash settlement and physical delivery. For USD/TRY futures and options, phsysical delivery is realized by exchange of money (USD) at the expiry date.

The settlement method for index options and futures, currency options and futures (except physically delivered USD/TRY contracts), precious metal (gold, silver, palladium, platinum) futures, metal futures, energy futures and TLREF futures are cash settlement. In this method, the profit/loss amount is exchanged at the expiry date. For options which are exercised, profit/loss at the expiry date is determined by the difference between strike price and settlement price at the expiry date.

Daily Settlement Price for Futures Contracts

The daily settlement price is calculated as follows at the end of the normal session and rounded to the nearest price tick:

a) The weighted average price of all the trades executed within the last 10 minutes of the normal session,

b) If less than 10 trades were realized in the last 10 minutes of the normal session, the weighted average price of the last 10 trades executed within the normal session,

c) If less than 10 trades were realized in the normal session, the weighted average price of all the trades executed during the normal session,

d) If no trades were realized during the normal session, the settlement price of the previous day will be determined as the daily settlement price.

If the daily settlement price cannot be calculated in accordance with the above methods by the end of the normal session, the settlement price may be determined by using the following methods singly or collectively.

a) The average of the best bid and ask quotations at the end of the normal session,

b) Theoretical prices are calculated considering spot price of the underlying asset or the daily settlement price for other contract months of the contract.

Trade reporting will not be taken into consideration. The right to change the daily settlement price by the Settlement Price Committee is under reserve.

Daily Settlement Price for Single Stock, Index, Mini Index and USDTRY Option Contracts

The daily settlement price is calculated as follows at the end of the normal session and rounded to the nearest price tick:

a) The weighted average price of all the trades executed within the last 10 minutes of the normal session,

b) If less than 10 trades were realized in the last 10 minutes of the normal session, the weighted average price of the last 10 trades executed during the normal session,

c) If less than 10 trades were realized in the normal session, the weighted average price of all the trades executed during the normal session,

d) If no trades were performed, theoretical prices calculated in consideration prices of underlying asset and other contracts based on the same underlying asset will be determined as the daily settlement price.

If the daily settlement price cannot be calculated in accordance with the above methods by the end of the normal session, or it is decided that the prices calculated do not reflect the market correctly, the Exchange may determine the daily settlement price in consideration of theoretical price, the previous day’s settlement price or the best bid and ask prices at the end of the normal session.

Trade reporting will not be taken into consideration in the above calculations. The Settlement Price Committee’s right to change the daily settlement price is under reserve.

Daily price change limits for future contracts is defined in the contract specifications by the Exchange. In the event that the upper or lower limit is calculated that it does not coincide with the price tick, the upper limit will be rounded to the lower price tick; and the lower limit, to the upper price tick. (For further information please refer to the Derivatives Market Procedure)

In the case of option contracts, strike prices refer to the prices at which the option holder may buy (for call options) and those at which the option holder may sell (put options).

Example 1:

O_AKBNKE0417C8.00 contract represents a European call option with a strike price of TL 8. This contract entitles its holder (investor with long position) to buy 100 units of Akbank equities at TL 8 at the maturity date of April 30, 2017.

If the spot price of the underlying security is over TL 8, the option contract is in-the-money, at TL 8, it is at-the-money, and if the price falls below TL 8, the option contract will be out-of-the-money.

Example 2:

O_AKBNKE0417P10.00 contract represents a European put option with a strike price of TL 10. This contract entitles its holders (investors with long position) to sell 100 units of Akbank equities at TL 10 at the maturity date of April 30, 2017.

If the spot price of the underlying security is below TL 10, the option contract is in-the-money, at TL 10, it is at-the-money, and if the price rises over TL 10, the option contract will be out-of-the-money.

Strike Price Ticks

Single Stock Option

The strike price tick for the single stock option contracts to start trading will be determined as follows on the basis of the price of the underlying asset, and will be applied as two digits after the comma.

| Option Contract Strike Price Intervals (TL) | Strike Price Tick (TL) |

|---|---|

| 0,01 – 0,99 | 0,02 |

| 1,00 – 2,49 | 0,05 |

| 2,50 – 4,99 | 0,10 |

| 5,00 – 9,99 | 0,20 |

| 10,00 – 24,99 | 0,50 |

| 25,00 – 49,99 | 1,00 |

| 50,00 – 99,99 | 2,00 |

| 100,00 – 249,99 | 5,00 |

| 250,00 – 499,99 | 10,00 |

| 500,00 – 999,99 | 20,00 |

| 1.000,00 and over | 50,00 |

By taking closing price of underlyings in spot market in previous trading day as base price and using theoretical price calculation method, at-the-money price levels are determined. Contracts with eight different (one at-the-money, one in-the-money and six out-of-the-money) strike price levels are opened.

In addition to standard strike prices, flexible contracts can be created by users with the strike prices which are between below/above 20% of minimum/maximum of the current strikes.

USD/TRY Options

Strike price of the USD/TRY option contracts is as following table.

| Option Contract Strike Price Intervals (TL) | Strike Price Tick (TL) |

|---|---|

|

1 – 99 |

1 |

|

100 – 249 |

2 |

|

250 – 499 |

5 |

|

500 – 999 |

10 |

|

1.000 – 2.499 |

25 |

|

2.500 – 4.999 |

50 |

|

5.000 – 9.999 |

100 |

|

10.000 – 24.999 |

250 |

|

25.000 – 49.999 |

500 |

|

50.000 and up |

1000 |

Theoretical price for each contract month are calculated on the basis of the value of multiplying the average of USDollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day by 1,000. At the Money strike price levels are determined using these theoretical prices for each contract month. At eleven different strike prices such that two is “in the money”, one is “at the money” and eight are “out of the money” shall be opened for each of call and put options.

In addition to standard strike prices, flexible contracts can be created by users with the strike prices which are between below/above 20% of minimum/maximum of the current strikes of all options.

BIST 30 Index Options

Strike price of the BIST 30 Index option contracts is determined as following table.

| Option Contract Strike Price Intervals (TL) | Strike Price Tick (TL) |

|---|---|

|

0,01 – 99,99 |

1,00 |

|

100,00 – 249,99 |

2,50 |

|

250,00 – 499,99 |

5,00 |

|

500,00 – 999,99 |

10,00 |

|

1.000,00 – 2.499,99 |

25,00 |

|

2.500,00 – 4.999,99 |

50,00 |

|

5.000,00 – 9.999,99 |

100,00 |

|

10.000,00 – 24.999,99 |

250,00 |

|

25.000,00 – 49.999,99 |

500,00 |

|

50.000,00 and up |

1.000,00 |

By taking previous day’s closing price of underlying (index) in spot market as base price and using theoretical price calculation method, at-the-money price levels are determined. Contracts with eleven different (one at-the-money, two in-the-money and eight out-of-the-money) strike price levels are opened.

In addition to standard strike prices, flexible contracts can be created by users with the strike prices which are between below/above 20% of minimum/maximum of the current strikes.

Strike Prices to be Introduced for Trading

Following regulations related to strike prices to be introduced for trading are in effect:

- New option strikes and ATM level may differ per expiration since they will be calculated according to the theoretical price (rather than spot price) of underlying

- ATM levels for each expiration will be published daily to our members via trading workplace and FIXRD (reference data) channels.

- Inactivation of option series due to underlying price changes will be ceased and auto generated options will be tradable until expiration date unless inactivated by mandatory reasons.

In the BISTECH system, at the money strike price level will be determined for each contract month by using the theoretical price calculation method based on the underlying price and the contracts will be created in the following numbers.

| Instrument Class | In The Money Contracts | At The Money Contracts | Out of The Money Contracts |

|---|---|---|---|

| Equity Options | 1 | 1 | 6 |

| BIST30 Index Options | 2 | 1 | 8 |

| USDTRY Options | 2 | 1 | 8 |

| Security Type | Final Settlement Price Calculation Method |

| Equity & Index Futures and Options Contracts | |

|---|---|

| BIST 30 Index Futures |

The final settlement price of BIST 30 futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST 30 Index Options |

For call options, the final settlement price shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The difference between the calculated weighted average price and strike price is rounded to the nearest price tick and called as the final settlement price. For put options, the final settlement price shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The difference between strike price and the weighted average price is rounded to the nearest price tick and called as the final settlement price. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Liquid Banks Index Futures |

The final settlement price of BIST Liquid Banks Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Liquid 10 Ex Banks Index Futures |

The final settlement price of BIST Liquid 10 Ex Banks Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Sustainability 25 Index Futures |

The final settlement price of BIST Sustainability 25 Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day |

| Single Stock Futures |

The final settlement price of single stock futures contracts shall be the closing price of the spot market session on the last trading day. On the last trading day, the expiry date settlement price is determined by the Settlement Price Committee if the session and/or closing session on the spot market is partially or completely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| Currency Futures Contracts | |

|---|---|

| USDTRY Futures |

The average of US Dollar selling and buying rate announced by the CBRT at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| EURTRY Futures |

The average of Euro selling and buying rate announced by the CBRT at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| EUR/USD Currency Futures |

CBRT EUR/USD Cross Rate of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| RUB/TRY Futures |

The average of RUB selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| CNH/TRY Futures |

The CNH/TRY rate calculated with exchange rate of USD/CNY (HK) announced by the Hong Kong Treasury Markets Association and average of USD/TRY selling and buying rates announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. If the final settlement price cannot be calculated due to public market holiday or any other reason the Settlement Price Committee will determine the final settlement price on the expiry day. |

| GBP/USD Futures |

Indicative GBP/USD Cross Rate announced by CBRT at 15:30 on the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| Currency Options Contracts | |

|---|---|

| USDTRY Options |

For call options, final settlement price is calculated as the difference between the value of multiplying the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day by 1,000 and the option contract’s strike price. The final value is rounded to the nearest price tick. For put options, final settlement price is calculated as the difference between the option contract’s strike price and the value of multiplying the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day by 1,000. The final value is rounded to the nearest price tick. If the related selling rate is not announced by CBRT on the last trading day, the final settlement price shall be determined by the Settlement Price Committee.” |

| Gold Futures Contracts | |

|---|---|

| Gold Futures |

LBMA Gold Price P.M. (released by ICE Benchmark Administration in the afternoon), shall be converted to TRY/gram price and called as the final settlement price. In calculations, the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 (for USDTRY conversion) and 31.1035 (for ounce/gram conversion) shall be used as the conversion factors. If the afternoon fixing price is not released, the gold fixing price (USD/ounce) released in the morning (A.M. price) shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask gold prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

| USD/Ounce Gold Futures |

LBMA Gold Price P.M. (released by ICE Benchmark Administration in the afternoon), shall be used as the final settlement price. If the afternoon fixing price is not released, the gold fixing price released (USD/ounce) in the morning (A.M. price) shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask gold prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

|

Silver Futures Contracts |

|

|

USD/Ounce Silver Futures |

LBMA Silver Price (released by ICE Benchmark Administration) of the last trading day, shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask silver prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

|

Palladium Futures Contracts |

|

|

USD/Ounce Palladium Futures |

The final settlement price of USD/Ounce Palladium futures contracts shall be calculated by taking the time weighted average of USD/Ounce Palladium prices (Mid Price) announced by Refinitiv with the code of XPD= on the last trading day between 17:00:00 - 17:00:59 (İstanbul Time). The final settlement price found by the above methods is rounded to the nearest price tick. If the prices are not released due to official holidays or another reason, absence of enough data or it is decided that the prices calculated do not reflect the market correctly, the final settlement price is determined by the Settlement Price Committee. |

|

Platinum Futures Contracts |

|

|

USD/Ounce Platinum Futures |

The final settlement price of USD/Ounce Platinum futures contracts shall be calculated by taking the time weighted average of USD/Ounce Platinum prices (Mid Price) announced by Refinitiv with the code of XPT= on the last trading day between 17:00:00 - 17:00:59 (İstanbul Time). The final settlement price found by the above methods is rounded to the nearest price tick. If the prices are not released due to official holidays or another reason, absence of enough data or it is decided that the prices calculated do not reflect the market correctly, the final settlement price is determined by the Settlement Price Committee. |

|

Copper Futures Contracts |

|

|

USD/Tonne Copper Futures |

The final settlement price on the last trading day is LME Official Settlement Price for Copper which is announced by London Metal Exchange as Tonne/USD for Grade A Copper. If the prices are not released due to official holidays or another reason, absence of enough data, the last LME Official Settlement Price is used as the final settlement price. It is decided that the prices calculated do not reflect the market correctly on the last trading day, the final settlement price is determined by the Settlement Price Committee. The final settlement price found by the above methods is rounded to the nearest price tick. |

| Energy Future Contracts | |

|---|---|

| Monthly Base-Load Electricity Futures Contracts |

The Last Settlement Price shall be the basic arithmetic average of the Unconstrained Market Clearing Prices announced by Turkish Electricity Transmission Company for each hour of the contract month. The Last settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

| Quarterly Base-Load Electricity Futures Contracts |

Since Quarterly contracts are subject to the cascading procedures, final settlement price is not calculated. |

| Yearly Base-Load Electricity Futures Contracts |

Since Yearly contracts are subject to the cascading procedures, final settlement price is not calculated. |

| Foreign Indices Future Contracts | |

|---|---|

| SASX 10 Index Futures |

The final settlement price of SASX 10 futures contracts shall be the closing price of the related index. The Last Settlement Price shall be rounded to the nearest tick. If the final settlement price cannot be calculated due to public market holiday or any other reason the Settlement Price Committee will determine the final settlement price on the expiry day. |

| Interest Rate Futures | |

|---|---|

| TLREF Futures |

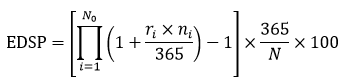

The final settlement price is calculated as follows and rounded to the nearest price tick:

N : The number of calendar days in delivery period The previous Turkish Lira Overnight Reference Rate may be used for days which the reference rate cannot be determined. The final settlement price will be determined by the Settlement Price Committee if the price is not determined with methods above or the calculated prices do not reflect the market accurately. |

| Government | |

|---|---|

| Government Bond Futures |

The weighted average clean price calculated for the T+1 value date of relavant underlying Government Debt Securities is accepted as the final settlement price. The final settlement price will be determined by the Settlement Price Committee if the spot market was partialy or entirey closed in the spot marketthat underlying securtiy traded or prices was not discovered despite the fact that the market was open on the last trading day. The price for physical delivery is dirty price found by adding the accured interest to settlement price. |

Final Settlement Price Calculation Methods above mentioned are prepared briefly for information purposes only. (For further information please refer to the Derivatives Market Procedure)