Underlying Security

Turkish Lira Overnight Reference Rate (TLREF) announced by Borsa İstanbul.

Contract Size

Nominal Value = TRY 1,000,000

![]()

Price Quotation and Minimum Price Tick

Price is entered to the system as a three digit value of interest rate multiplied by 100. (Example: 20.050, 20.060 etc.) Price tick is 0.010 which corresponds to TRY 8.33.

Contract Months

All calendar months (The current contract month and the nearest 6 contract months shall be concurrently traded)

Settlement

Cash Settlement

Settlement Period

T+1 (first day following the expiry date) Losses are deducted from the accounts at the end of T day, profits are added to the accounts on T day as well.

Trading Hours

Continuous trading from 09:20 to 18:10 (local time)

Daily Settlement Price

The daily settlement price is calculated as follows at the end of the normal session and rounded to the nearest price tick:

a) The weighted average price of all the trades executed within the last 10 minutes of the normal session,

b) If less than 10 trades were realized in the last 10 minutes of the normal session, the weighted average price of the last 10 trades executed during the normal session,

c) If less than 10 trades were realized in the normal session, the weighted average price of all the trades executed during the normal session,

d) If no trades were done during the normal session, the previous day settlement, will be determined as the daily settlement price.

If the daily settlement price cannot be calculated with the above methods by the end of the normal session, or the prices calculated do not reflect the market correctly, the daily settlement price may be determined by using one or more of the following methods

a) The average of the best buy and sell quotations at the end of the normal session,

b) Theoretical prices are calculated considering spot price of the underlying asset or the daily settlement price for other contract months of the contract.

Trade reporting will not be taken into consideration in the above calculations. The Settlement Price Committee’s right to change the daily settlement price is under reserve.

Final Settlement Price

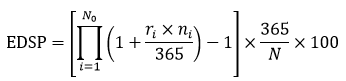

The final settlement price is calculated as follows and rounded to the nearest price tick:

N : The number of calendar days in delivery period

N0 : The number of business days in the calculation period.

ni : The number of calendar days in the relevant calculation period on which the rate is 𝑟i

ri :The overnight reference rate announced by Borsa İstanbul for 𝑖 day

The previous Turkish Lira Overnight Reference Rate may be used for days which the reference rate cannot be determined.

The final settlement price will be determined by the Settlement Price Committee if the price is not determined with methods above or the calculated prices do not reflect the market accurately.

Delivery Period

Term specified in the contract code (Example: The delivery period for the F_TLREF1M1219 contract is December 2019).

Expiry Date

Last business day of the delivery period.

Last Trading Day

Last business day of the delivery period.

Daily Price Limit

Base price is the price determined by the Settlement Price Committee on the day the relevant contract is introduced for trading, and used in calculating the daily price limits. For the other days, base price is the settlement price of the previous day.

Daily price limit is equal to ±20% of the base price determined for each contract. If the upper or lower limit calculated does not correspond to a price tick, the upper limit will be rounded to the lower price tick; and the lower limit, to the upper price tick.

Margins

Clearing legislation shall be applied.