| Security Type | Final Settlement Price Calculation Method |

| Equity & Index Futures and Options Contracts | |

|---|---|

| BIST 30 Index Futures |

The final settlement price of BIST 30 futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST 30 Index Options |

For call options, the final settlement price shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The difference between the calculated weighted average price and strike price is rounded to the nearest price tick and called as the final settlement price. For put options, the final settlement price shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The difference between strike price and the weighted average price is rounded to the nearest price tick and called as the final settlement price. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Liquid Banks Index Futures |

The final settlement price of BIST Liquid Banks Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Liquid 10 Ex Banks Index Futures |

The final settlement price of BIST Liquid 10 Ex Banks Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| BIST Sustainability 25 Index Futures |

The final settlement price of BIST Sustainability 25 Index futures contracts shall be calculated by weighting of the time weighted average of index values of the last 30 minutes of continuous auction in the equity market and closing price of the index with 80% and 20%, respectively. The calculated weighted average is rounded to the nearest price tick. The final settlement price will be determined by the Settlement Price Committee if the session and/or closing session in the spot market was partly or entirely closed, or price was not discovered despite the fact that the market was open on the last trading day |

| Single Stock Futures |

The final settlement price of single stock futures contracts shall be the closing price of the spot market session on the last trading day. On the last trading day, the expiry date settlement price is determined by the Settlement Price Committee if the session and/or closing session on the spot market is partially or completely closed, or price was not discovered despite the fact that the market was open on the last trading day. |

| Currency Futures Contracts | |

|---|---|

| USDTRY Futures |

The average of US Dollar selling and buying rate announced by the CBRT at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| EURTRY Futures |

The average of Euro selling and buying rate announced by the CBRT at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| EUR/USD Currency Futures |

CBRT EUR/USD Cross Rate of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| RUB/TRY Futures |

The average of RUB selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| CNH/TRY Futures |

The CNH/TRY rate calculated with exchange rate of USD/CNY (HK) announced by the Hong Kong Treasury Markets Association and average of USD/TRY selling and buying rates announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day. The Last Settlement Price shall be rounded to the nearest tick. If the final settlement price cannot be calculated due to public market holiday or any other reason the Settlement Price Committee will determine the final settlement price on the expiry day. |

| GBP/USD Futures |

Indicative GBP/USD Cross Rate announced by CBRT at 15:30 on the last trading day. The Last Settlement Price shall be rounded to the nearest tick. |

| Currency Options Contracts | |

|---|---|

| USDTRY Options |

For call options, final settlement price is calculated as the difference between the value of multiplying the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day by 1,000 and the option contract’s strike price. The final value is rounded to the nearest price tick. For put options, final settlement price is calculated as the difference between the option contract’s strike price and the value of multiplying the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 of the last trading day by 1,000. The final value is rounded to the nearest price tick. If the related selling rate is not announced by CBRT on the last trading day, the final settlement price shall be determined by the Settlement Price Committee.” |

| Gold Futures Contracts | |

|---|---|

| Gold Futures |

LBMA Gold Price P.M. (released by ICE Benchmark Administration in the afternoon), shall be converted to TRY/gram price and called as the final settlement price. In calculations, the average of US Dollar selling and buying rate announced by the Central Bank of the Republic of Türkiye at 15:30 (for USDTRY conversion) and 31.1035 (for ounce/gram conversion) shall be used as the conversion factors. If the afternoon fixing price is not released, the gold fixing price (USD/ounce) released in the morning (A.M. price) shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask gold prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

| USD/Ounce Gold Futures |

LBMA Gold Price P.M. (released by ICE Benchmark Administration in the afternoon), shall be used as the final settlement price. If the afternoon fixing price is not released, the gold fixing price released (USD/ounce) in the morning (A.M. price) shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask gold prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

|

Silver Futures Contracts |

|

|

USD/Ounce Silver Futures |

LBMA Silver Price (released by ICE Benchmark Administration) of the last trading day, shall be used as the final settlement price. If the fixing prices are not released due to official holidays or another reason, the average of bid and ask silver prices (USD/ounce) announced on the international spot market at 17:00 (Istanbul time) shall be used. The final settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

|

Palladium Futures Contracts |

|

|

USD/Ounce Palladium Futures |

The final settlement price of USD/Ounce Palladium futures contracts shall be calculated by taking the time weighted average of USD/Ounce Palladium prices (Mid Price) announced by Refinitiv with the code of XPD= on the last trading day between 17:00:00 - 17:00:59 (İstanbul Time). The final settlement price found by the above methods is rounded to the nearest price tick. If the prices are not released due to official holidays or another reason, absence of enough data or it is decided that the prices calculated do not reflect the market correctly, the final settlement price is determined by the Settlement Price Committee. |

|

Platinum Futures Contracts |

|

|

USD/Ounce Platinum Futures |

The final settlement price of USD/Ounce Platinum futures contracts shall be calculated by taking the time weighted average of USD/Ounce Platinum prices (Mid Price) announced by Refinitiv with the code of XPT= on the last trading day between 17:00:00 - 17:00:59 (İstanbul Time). The final settlement price found by the above methods is rounded to the nearest price tick. If the prices are not released due to official holidays or another reason, absence of enough data or it is decided that the prices calculated do not reflect the market correctly, the final settlement price is determined by the Settlement Price Committee. |

|

Copper Futures Contracts |

|

|

USD/Tonne Copper Futures |

The final settlement price on the last trading day is LME Official Settlement Price for Copper which is announced by London Metal Exchange as Tonne/USD for Grade A Copper. If the prices are not released due to official holidays or another reason, absence of enough data, the last LME Official Settlement Price is used as the final settlement price. It is decided that the prices calculated do not reflect the market correctly on the last trading day, the final settlement price is determined by the Settlement Price Committee. The final settlement price found by the above methods is rounded to the nearest price tick. |

| Energy Future Contracts | |

|---|---|

| Monthly Base-Load Electricity Futures Contracts |

The Last Settlement Price shall be the basic arithmetic average of the Unconstrained Market Clearing Prices announced by Turkish Electricity Transmission Company for each hour of the contract month. The Last settlement price determined with the above-mentioned methods shall be rounded to nearest price tick. |

| Quarterly Base-Load Electricity Futures Contracts |

Since Quarterly contracts are subject to the cascading procedures, final settlement price is not calculated. |

| Yearly Base-Load Electricity Futures Contracts |

Since Yearly contracts are subject to the cascading procedures, final settlement price is not calculated. |

| Foreign Indices Future Contracts | |

|---|---|

| SASX 10 Index Futures |

The final settlement price of SASX 10 futures contracts shall be the closing price of the related index. The Last Settlement Price shall be rounded to the nearest tick. If the final settlement price cannot be calculated due to public market holiday or any other reason the Settlement Price Committee will determine the final settlement price on the expiry day. |

| Interest Rate Futures | |

|---|---|

| TLREF Futures |

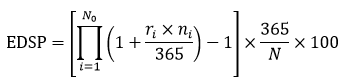

The final settlement price is calculated as follows and rounded to the nearest price tick:

N : The number of calendar days in delivery period The previous Turkish Lira Overnight Reference Rate may be used for days which the reference rate cannot be determined. The final settlement price will be determined by the Settlement Price Committee if the price is not determined with methods above or the calculated prices do not reflect the market accurately. |

| Government | |

|---|---|

| Government Bond Futures |

The weighted average clean price calculated for the T+1 value date of relavant underlying Government Debt Securities is accepted as the final settlement price. The final settlement price will be determined by the Settlement Price Committee if the spot market was partialy or entirey closed in the spot marketthat underlying securtiy traded or prices was not discovered despite the fact that the market was open on the last trading day. The price for physical delivery is dirty price found by adding the accured interest to settlement price. |

Final Settlement Price Calculation Methods above mentioned are prepared briefly for information purposes only. (For further information please refer to the Derivatives Market Procedure)